Maersk reopens Red sea route: Impact on freight rates, competition & shipping industry

Maersk becomes the first carrier to fully shift MECL service back to the Red Sea via Suez.

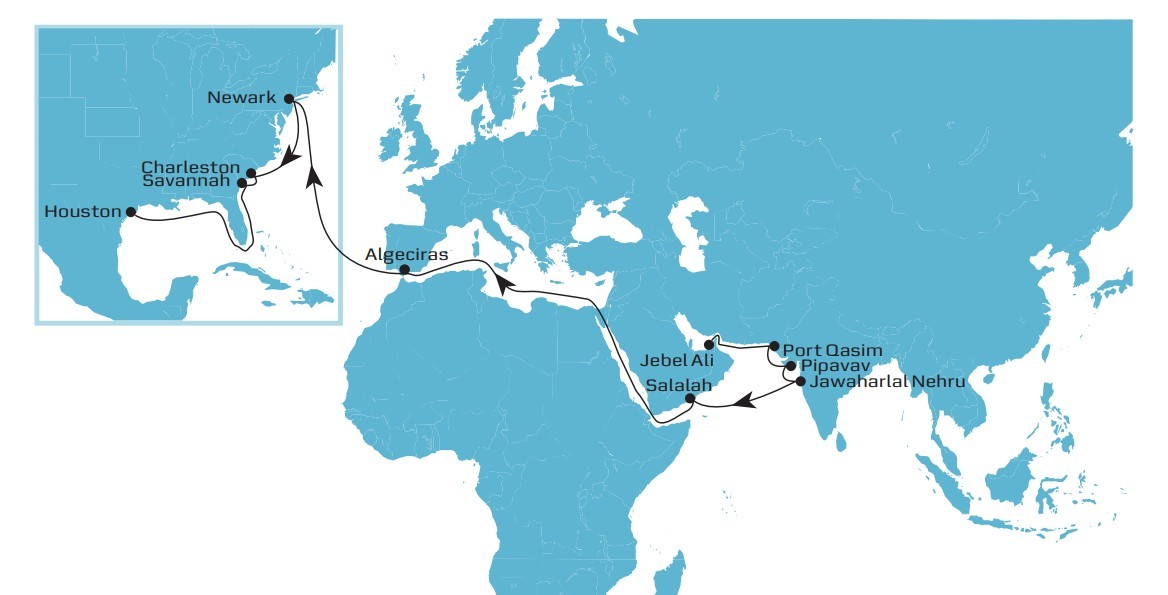

On 15 January 2026, Maersk officially announced the shift of all vessels under its MECL (Middle East – India – Europe – US East Coast) service back to the Red Sea passage via the Suez Canal. This marks the first instance of a global container shipping line moving an entire service back to the Red Sea after years of disruption.

Below is a diagrammatic presentation of MECL service route

Why Maersk moved first

Shipping lines know that a price war is inevitable. The only question is when. Maersk’s move suggests it prefers to face this phase early and strategically, rather than later under worse market conditions.

To understand why Maersk is the first major carrier to move a complete service back to the Red Sea, we must look at fleet strategy and competitive positioning.

Fleet Comparison (Current Trend)

MSC: ~973 vessels, with ~120 more on order

Maersk: ~729 vessels, with ~79 in the pipeline

MSC has aggressively reinvested its COVID-era profits into fleet expansion. Maersk, on the other hand, diverted a significant portion of its profits into integrated logistics, terminals, warehousing, and supply chain solutions.

By reopening the Red Sea route early, Maersk may be:

Intentionally accelerating capacity pressure

Forcing freight rates downward sooner rather than later

Testing competitors’ cost resilience

With a comparatively smaller fleet, Maersk could be better positioned to withstand a price war than carriers overloaded with new tonnage.

The reopening of the Red Sea will likely trigger:

Aggressive rate competition

Higher blank sailings

Service rationalization

Increased alliance-level coordination

What we see ahead - Mergers and acquisitions

Historically, downturns in shipping lead to industry consolidation. Weak players struggle, while strong balance sheets go shopping.

We may see:

Mergers between mid-sized carriers

Strategic acquisitions to gain scale or regional dominance

Reduction in the total number of global shipping lines

Maersk has already lost its long-held Number 1 position to MSC. With its focus on end-to-end logistics rather than pure shipping scale, it would not be surprising if Maersk explores merger or acquisition opportunities in the coming years to strengthen its ocean footprint. I have a strong feeling that in coming years Maersk will – either acquire Hapag Lloyd or merge it .

One possible long-term scenario could involve a strategic merger or acquisition involving a major European carrier, reshaping the competitive landscape once again.

What This Means for Shippers and the Market

For exporters and importers, the reopening of the Red Sea is broadly positive:

Shorter transit times

Gradual softening of freight rates

Improved schedule reliability

However, volatility will remain. As competition intensifies, service quality, blank sailings, and sudden rate adjustments will continue to challenge supply chain planning.

Maersk’s decision to restart Red Sea routing for its MECL service is not just an operational move, it is a calculated strategic statement aimed at reshaping market dynamics. It signals confidence in regional stability, readiness for intensified competition, and a willingness to shape the next phase of the shipping cycle.

As capacity pressures rise and freight rates come under stress, the industry is likely heading toward price wars, consolidation, and structural change. The Red Sea reopening may well be the trigger that accelerates this transformation.

The shipping world is entering another defining chapter and Maersk has chosen to move first.

Popular Posts

Explore Topics

Comments