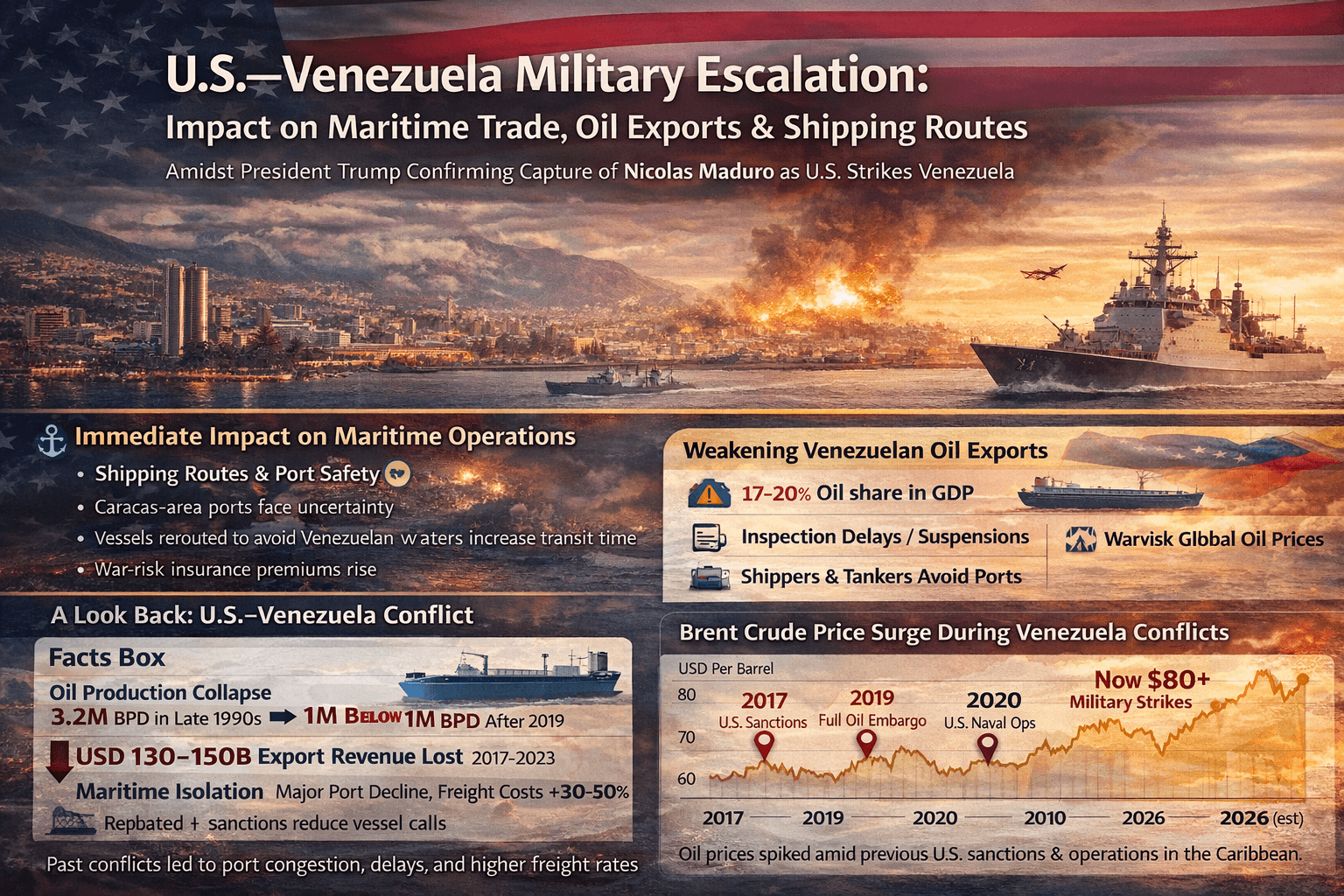

US Venezuela Military Escalation: What It Means for Maritime Trade, Oil Exports and Global Shipping Routes

Recently, just few hours back US president Donald Trump said he has captured Venezuelan leader, Nicolas Maduro and his wife. This military escalation between the United States and Venezuela has triggered serious concerns which is going far beyond geopolitics. As reports emerge of U.S. strikes and heightened tensions with President Nicolás Maduro’s government, the global maritime industry, exports, and imports linked to Venezuela are once again in a bad situation.

Venezuela is not just another regional player — it is an important maritime nation, having world’s largest oil reserves. This escalation will have immediate impact on shipping lanes, energy markets, marine insurance, and port operations.

Immediate Impact on Maritime Operations of this military confrontation

Shipping Routes & Port Safety

Military activity raises red flags for commercial shipping. With airspace restrictions, naval movement, and security alerts increasing:

Caracas-area ports and Caribbean terminals face operational uncertainty

Vessels routed from this area will have an increase transit time as Shipping companies may reroute vessels to avoid Venezuelan waters

War-risk premiums on marine insurance are likely to rise

Historically, even limited conflict in the Caribbean has led to port congestion, delays, and higher freight costs.

Impact on Venezuelan Exports, Economy and Historical conflicts

Oil Exports and oil price at Risk

Oil comprises of 17% to 20% of Venezuelan GDP, thus a hold on oil export can impact the economy. Past Venezuela’s economy is sanctions and conflicts already reduced export volumes sharply.

With renewed military tension:

Oil shipments may face inspection delays or outright suspension

Tanker owners and importers may avoid Venezuelan ports due to sanctions compliance and safety risks

Global oil prices may see short-term volatility if exports drop suddenly

For maritime energy traders, Venezuela remains a high-risk but high-impact exporter.

A Look Back: U.S.–Venezuela Conflict History

The current situation did not arise overnight.

Key historical flashpoints include:

Early 2000s: Political tensions after Hugo Chávez’s rise

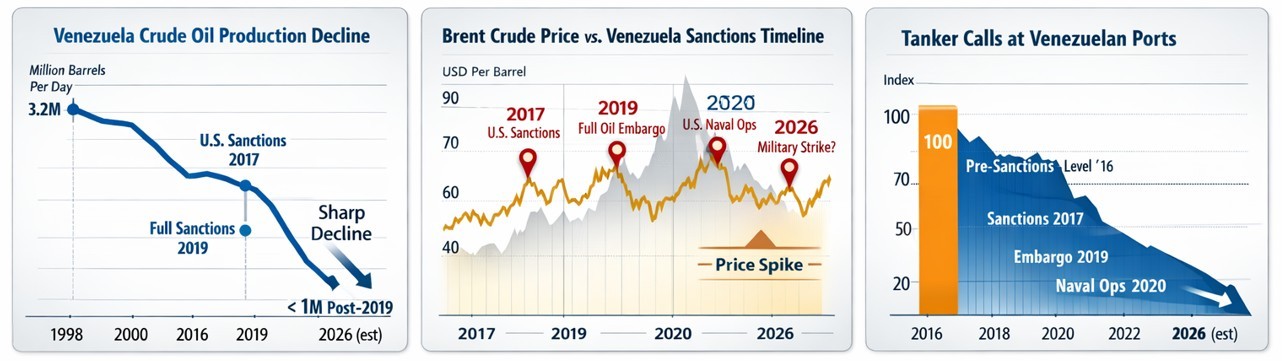

2017–2019: U.S. sanctions on Venezuelan oil, shipping, and finance

2020: U.S. naval operations in the Caribbean targeting alleged narcotics routes

Repeated sanctions enforcement on tankers, ports, and shipping intermediaries

Each phase of conflict resulted in:

Reduced vessel calls

Higher compliance costs

Fragmented trade routes using intermediaries

The maritime industry has long treated Venezuela as a sanctions-sensitive trade zone.

Economic & Trade Losses (Key Facts)

Oil production collapse:

Venezuela’s crude oil output fell from over 3.2 million barrels per day (bpd) in the late 1990s to below 1 million bpd after 2019, largely due to sanctions, underinvestment, and export restrictions.Export revenue losses:

Between 2017 and 2023, Venezuela is estimated to have lost over USD 130–150 billion in oil export revenues, as U.S. sanctions restricted tanker movements, port access, and dollar-based trade settlements.Maritime isolation:

Many international shipping companies stopped calling Venezuelan ports due to:Sanctions compliance risks

Insurance refusal for sanctioned cargo

Fear of vessel detention or payment defaults

Several vessels carrying Venezuelan crude were sanctioned or denied insurance, forcing trade to move via ship-to-ship (STS) transfers and indirect routes, increasing freight costs by 30–50% in some cases.

Major ports such as Puerto José and La Guaira experienced declining throughput, equipment shortages, and reduced foreign operator participation.

While the news will be regular on military and political drama, the real, lasting consequences may be felt at sea — through disrupted exports, cautious shipowners, rising insurance costs, and fragile supply chains.

The U.S.–Venezuela conflict once again proves a critical lesson for global trade:

Geopolitics and maritime commerce are inseparable; Lets see what future brings.

While Venezuela itself is no longer a swing producer, any escalation involving its oil sector may impacts global market.

Popular Posts

Explore Topics

Comments