Trump’s Tariffs Impact on Canada’s Economy: Trade Disruption and loss.

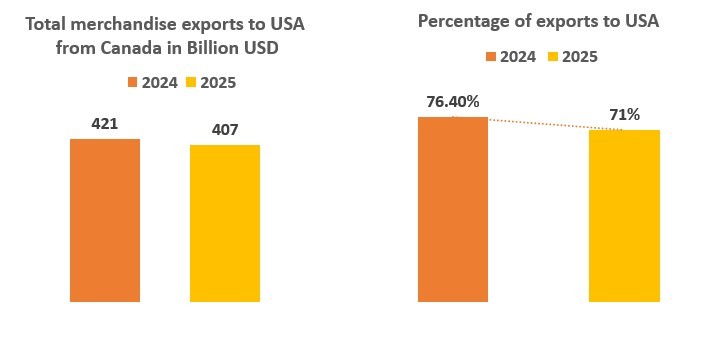

We expect a reduction in Canadian merchandise exports to USA for 2025 by 14 to 20 billion USD and the profit for exporters have reduced drastically due to tariff leading the price increase. We will discuss this in detail in this blog.

In 2025, the Trump administration implemented sweeping tariff measures that significantly altered U.S.–Canada trade dynamics and had broad economic consequences for Canada — one of the United States’ closest trading partners. These policies had both immediate and longer-term effects on Canadian trade, industrial output, GDP growth, prices, and employment.

Canada’s Trade Exposure to the U.S.

Canada is highly integrated with the U.S. economy. In 2024, roughly 76.40 % of Canadian merchandise exports was done to USA and same has reduced to 68% to 71% in 2025. Also the exports value of cargo from Canada to USA reduced from 421 Billion USD to 407 Billion USD from 2024 to 2025 exports. This does not include the drastic reduction in profit due to tariff .

Expected loss the Canadian Economy

The Bank of Canada projects that the tariff-induced disruptions could suppress economic growth by almost 3 % over two years, largely due to weakened export and investment activity.

A 25 % tariff regime on Canadian exports could reduce real GDP growth by 2.7 % in 2025 and 4.3 % in 2026 relative to baseline forecasts.

The Conference Board of Canada estimates that such tariff, if sustained, would reduce Canadian output relative by about 2.4 % lower by the end of 2026 than the situation if tariffs had not been imposed.

Loss due to inflation – Canada also reciprocated tariff to USA and as a general understanding the loss is being shared by buyer and seller and same will pass on to the end buyer , this will create an inflation for Canada’s Consumer Price Index (CPI) because roughly 13 % of the CPI basket consists of U.S.-origin goods.

A weaker Canadian dollar partly driven by trade tensions amplifies tariff effects by making all imports more expensive, as a weaker currency has to paid in higher amount for imports.

Tariffs on metals and autos directly threaten 100,000–160,000 jobs, mainly in Ontario, Quebec, and Alberta, where export-oriented manufacturing and resource industries dominate.

Below are the detail of Trump tariff implementation since Feb 2025

March 4, 2025 — 25% General Tariff on Canadian Imports

March 12, 2025 — 25% Tariff on Canadian Steel & Aluminium

March 12, 2025 — Threat of Increased 50% Steel & Aluminium Tariff

April 2, 2025 — 25% Tariff on Foreign-Made Automotive Goods

August 1, 2025 — Tariff Increase to 35% + 50% on Steel and Aluminium

Final take away for Canada

While Canada remains protected to some extent under USMCA, Trump’s tariff strategy has demonstrated how vulnerable even close allies are to unilateral trade actions. The expected damage do underscores a harsh reality: in modern, interconnected supply chains, tariffs act less as protection and more as a self-inflicted economic tax on both sides of the border.

Popular Posts

Explore Topics

Comments