Contents

- Expected impact on exports from USA

- Expected impact on imports to USA

- Impact on Global Trade

- Analysis of his first term of presidency

- Short term impact

- Long term impact

- Trump’s win would be beneficial for

- Geographical shift on USA imports in last 2 years

- Upcoming supply chain challenges for Trump.

Expected Impact on exports from USA

- Exports should increase – on his popular “America First” Policy – The focus will be more on domestic manufacturing additionally Onshoring and Nearshoring manufacturing would shift to USA and its bordering countries to Mexico and Latin America.

Expected Impact on Imports to USA

- Trump has been promoter of USA manufacturing, and will impose duty on imports.

- In election speeches –

- He promised a 20% hike in overall imports to USA

- Additionally, 60% hike for Chinese imports.

- We foresee, Changes in section 301 for imports tariffs for all countries and harder on Chinese imports.

Impact on Global Trade

- Disruption in Global Supply Chain.

- He will work on “AMERICA FIRST” Agenda, leading to tariff imposition on imports from different countries, especially China for sectors like – automotive & electronics.

- The tariff impositions will lead to reciprocation from many countries, this will impact on many global manufacturing companies as the cost will rise , leading to supply chain interruption in there production lines.

- Trump can reduce USA participation in WTO.

- The USA manufacturing units in China can shift to – Mexico, India, Taiwan, Philippines and Eastern Europe.

- The countries which will be not be able to enter USA market due to high tariffs will make regional alliances to decrease dependency in USA.

- He is only US president in last few decades who did not start war on his term. He talks to stop the global wars going on, Russia-Ukraine & Israel-Gulf Countries.

- This could lead to smooth transition of global shipping to pre-covid era transit and service.

- Issues like Red Sea Challenge and risk of vessels in movement in Black Sea might stop.

Analysis of his first term of presidency:-

- Time Duration – 20th January, 2017 to 20th January 2021.

- Term – He was 45th president of USA.

- If we analyze his first term of presidency, his immediate steps were tariff impositions.

- 2017 – Tax reforms – Said to be rocket fuel for manufacturers (Manufacturing production grew 2.7% in 2018. Dec 2018 was the highest manufacturing output since after May 2008.)

- 2017 – USA withdrew from Trans Pacific Partnership

- 2017 – USA withdrew from Paris Agreement

- 2018 – Beginning of USA-China Trade War

- 2020 – NAFTA was changed to USMCA – [NAFTA (North American Free Trade Agreement) NAFTA was replaced with USMCA (United States-Mexico-Canada Agreement)]

He understood their dependency is too much on one country – China. USA felt it was a necessity to have geographical diversification for their supplies and US started shifting their need geographically and below were few of the changes

- From 2018 to 2020

- Mexico – The growth in there manufacturing sector was 17%.

- Vietnam – US imports from Vietnam increased by 1.5 times, majority of the material were electronics.

Short term impact –

- The importers would push to get cargo soon before imposition of tariff, this can lead to a sudden rise in Ocean Freight for upcoming 2 to 3 months.

- Importers are checking the freight to understand the market and take possible actions in the quick span of time.

- Disruption in supply chain as manufacturing companies will not be able to quickly adapt and change their reliance on China for equipment and parts.

Long term impact –

- The imports from China can be impacted.

- The global flow of cargo will change.

- Recently Mexico has become USA largest cargo importing country.

- The flow of cargo from China to Mexico will increase.

- Onshoring and Offshoring will increase in USA and bordering countries.

Trump’s win would be beneficial for

- Companies those set up and put money into manufacturing during Trumps first term will be in a better position.

- For countries that can be alternative for China

- Vietnam – Has proved to be a reliable partner since 2017.

- India – Make in India is working and can be a game changer.

- Mexico – USA imports will increase further from Mexico, its already USA largest importer now + Chinese are preparing for nearshoring at Mexico.

- EU – Has been reliable trade partner since long.

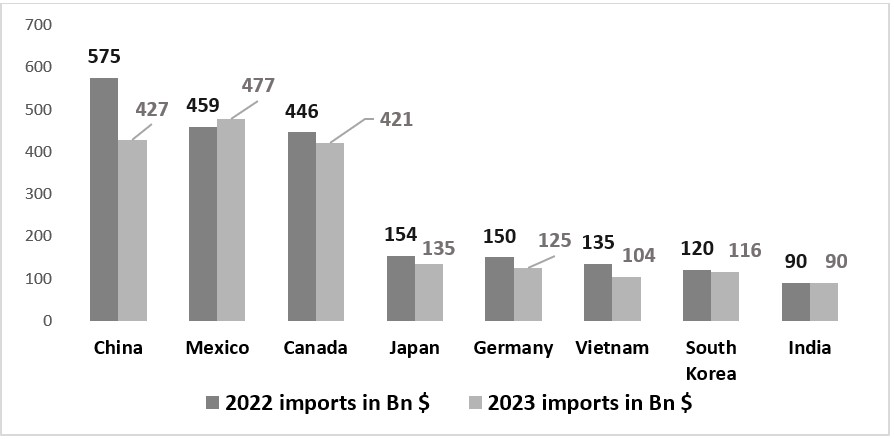

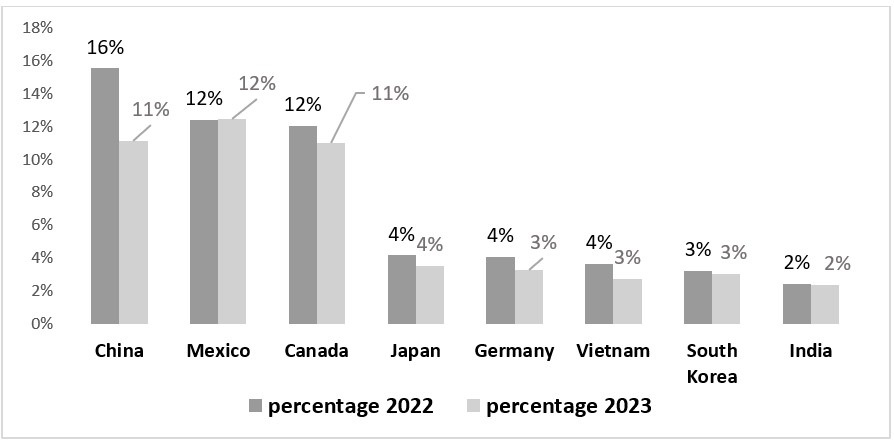

Geographical shift on USA imports in last 2 years

If we compare the USA imports for 2022 and 2023 for top 8 countries we can relate the shift of volume from China to Mexico.

Below is the analysis for percentage share of top 8 country wise imports ,as per total imports of approx. 3.7 Trillion $ for 2022 and approx. 3.8 trillion $ for 2023 , this includes data for imports of both goods and services.

Source of data – https://www.bea.gov/ (Bureau of Economic Analysis of USA). Above is an approximate data.

Upcoming supply chain challenges for Trump.

- USA East Coast Labor issue is not resolved. An agreement should be finalized within 15th Jan or another strike can be there. The ports were already closed from 1st Oct 2024 to 3rd Oct 2024 due to strike and later the agreement was extended till 15th Jan 2025. This is a complicated problem and if not taken care on time it can be largest global supply chain disruption of the decade. In our past blogs in new column we shared details of USA East coast pre-strike and post-strike. Please click on the links to read further.

- USA dependency is still high on China, and a tariff imposition will need to find alternatives to impact the supply chain. For Few products there are still no alternatives other than China – like rare-earth minerals.

- International maritime disruption due to blockage of Red Sea due to Houthi rebels , still most of the vessels are passing through Cape of Good Hope and whole industry is paying for the higher freight and increase transit. We have posted earlier with detail analysis of Red Sea Challenge .