Content

- Introduction

- Rate increase from June to July

- Reason for rate increase

- By when the rates will be back to moderate level

- Other challenges waiting to come into picture

- Conclusion

1. Introduction

There has been a surge in ocean freight since mid of June which aggravated in July. The freight rate is soaring now and in addition there are other challenges line equipment / space / vessel availability. In this blog we will discuss the rate increase from East to West, the reason for it and other challenges which can be faced in August and coming months.

2. Ocean Freight Rate increase from June to July

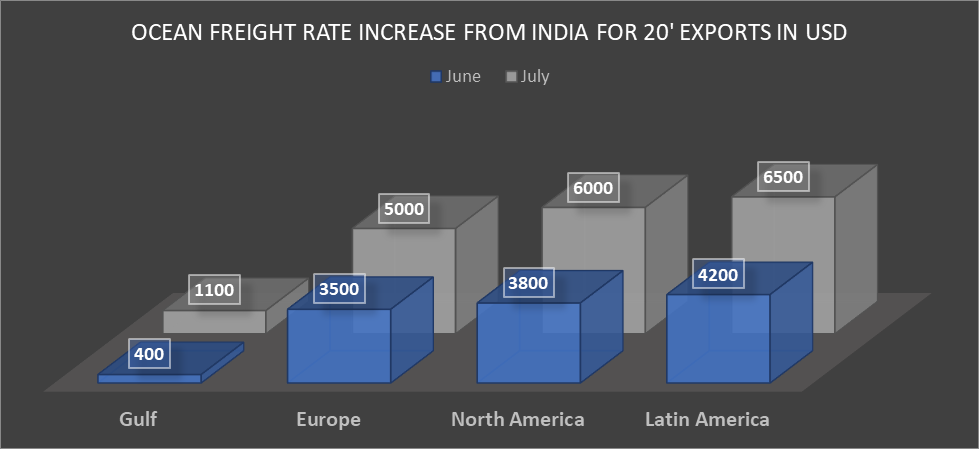

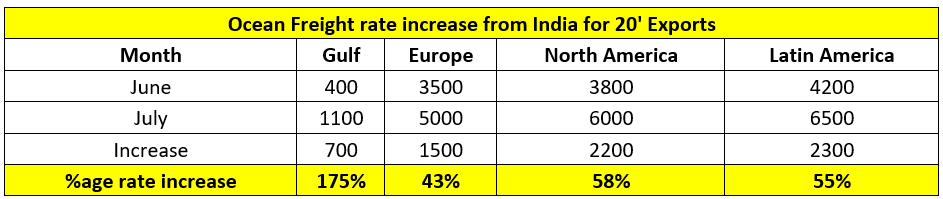

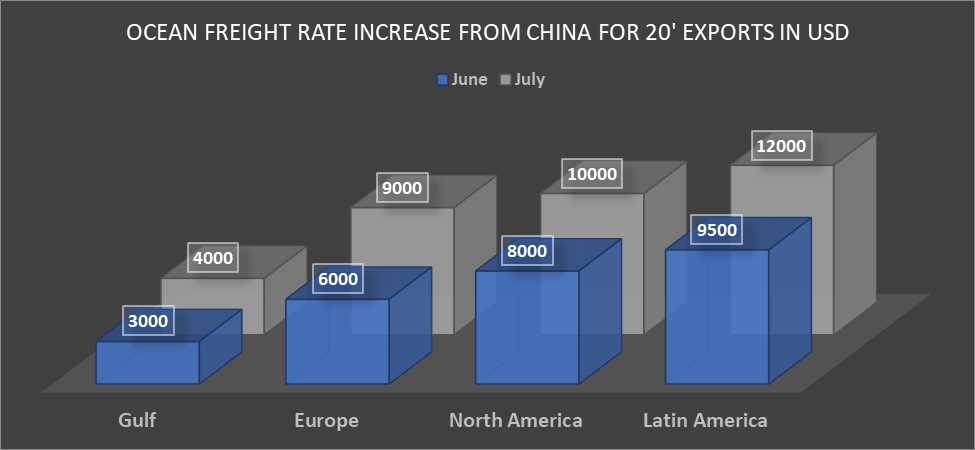

We will look over the rate increase from two large economies – India and China

I. From India the average increase has been as below for over-all destination for different continents.

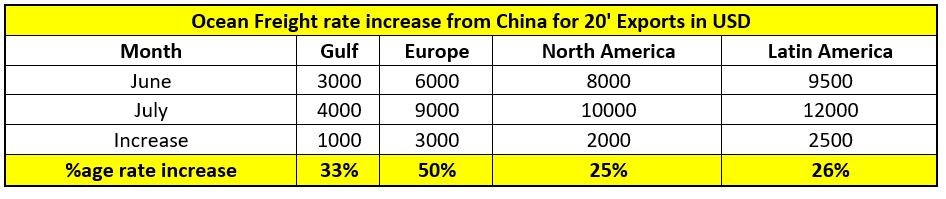

II. From China the average increase has been as below for over-all destination for different continents.

Note – The above rate is average rate as per market information and can vary as per situation on spot during different weeks of the month.

If we compare the Ocean freight from Nov 23 to July 24 – The Ocean Freight has increased by approx. 4 to 5 times for Europe, North America, Latin America.

3. Reason for rate increase.

I. Red Sea Challenge – This has led to vessels moving from Cape of good hope instead of Suez Canal leading to increase in voyage transit leading to less availability of vessels / blank calls for services creating a space reduction. This has been briefly discussed in our earlier blogs, you can click here to read it.

II. Container pile up at transshipment ports – As a process – the containers are picked up from feeder ports / small ports are taken to major transshipment ports to be carried by mother vessels with longer voyages. Due to disruption of vessel routing for above reason, below impact can be seen.

a.) More than 1,50,000 containers are piled up at Colombo waiting for mother vessel. There is heavy container congestion at Colombo port.

Since the freight is high from China, most vessels are getting filled up at China and are making blank calls at Colombo.

b.) At Singapore the vessel waiting time has increased to more than 5 days due to vessel congestion. There are more than 1 million containers directly impacted.

For first time the congestion has reached the level seen at time of pandemic during 2019.Colombo and Singapore are two major transshipments ports for container movement from East to West.

III. Increase in demand for exports from China with limited Capacity – There has been a sudden increase in demand from China for exports since June’ 24. The Ocean freight rates are presently highest from China due to rise in demand leading to all shipping lines targeting exports from China.

IV. As per past experience gained by shippers after pandemic – If they feel there is going to be a space issue in coming month they would start exporting more, also the consignees are buying more and stocking the cargo in their warehouses.

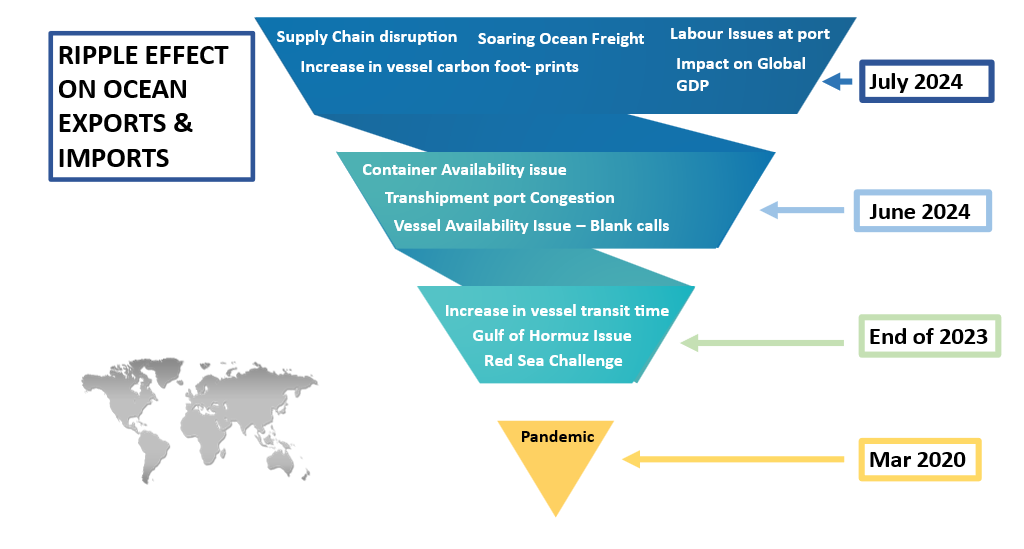

V. This is the ripple effect of all global exports challenges faced since Mar 2020 during pandemic, Red Sea Challenge, Israel Iran war impact on Gulf of Hormuz, vessel transit increase, soaring freight charges and Supply Chain disruption.

Below is the pictorial representation of the ripple effect

4. By when the rates will be back to moderate level

Ocean freight does not seem to reduce for next 2 months, since Q3 is the peak season for global exports market, the demand will be higher than Q2 and with limited supply of space the freight will increase further.

As per few supply chain consultants the freight will increase further in coming months. The vessel chartering market is at a high vessel. There are cases where the vessel chartering cost has gone up to USD 1,50,000 per day.

With increase in number of vessels in the Ocean and with more containers and without any global crisis the rates could be seen to start coming back to moderate level from Oct 2024.

5. Other challenges waiting to come into picture

I. USA East Coast labour issue – There has been labour union strike like situation, seen at the horizon and looming in at USA East coast ports. The biggest maritime union of USA – Longshoremen’s Association cancelled talks with port employers at Newark recently. The union is fighting for huge reduction on labour force at few ports after automation of work.

The expiration of present contract is in Nov 2024 and present labour union is fighting for its existence.

Till now, the situation has not yet come to point of strike, but in case of a strike, it would lead to port closure, vessel waiting time increase and huge supply chain disruption.

II. European Countries labour issue – There has another issue going on at Germany – where dock workers are demanding better pay and can halt the work due to this. There has been same situation in few other countries of Europe.

III. Spiral effect of these events to further increase freight – The worlds largest export market is China. If freight increases from China most of shipping line will target exports from China leading to further equipment and vessel shortage at other locations.

SCFI (Shanghai Container Freight Index) has seen an increase for 11 consecutive weeks and now the index is at level of last September, this is a sign of high exports demand from China in coming two months.

IV. Peak Season – Conventionally at USA East coast the demand is at peak in August, thus Aug’ 2024 will bring further increase in freight.

6. Conclusion

Since Mar 2020 world is facing the high freight and it does not seem to reduce to normal level in coming months. Apart from paying high freights there is a lot learn from this situation.

Problems are not always negative and Change is constant.